Insider Login

AOTCA President Shares Insights on Global Minimum Tax and Transfer Pricing at CFO Roundtable

03 Oct 2025

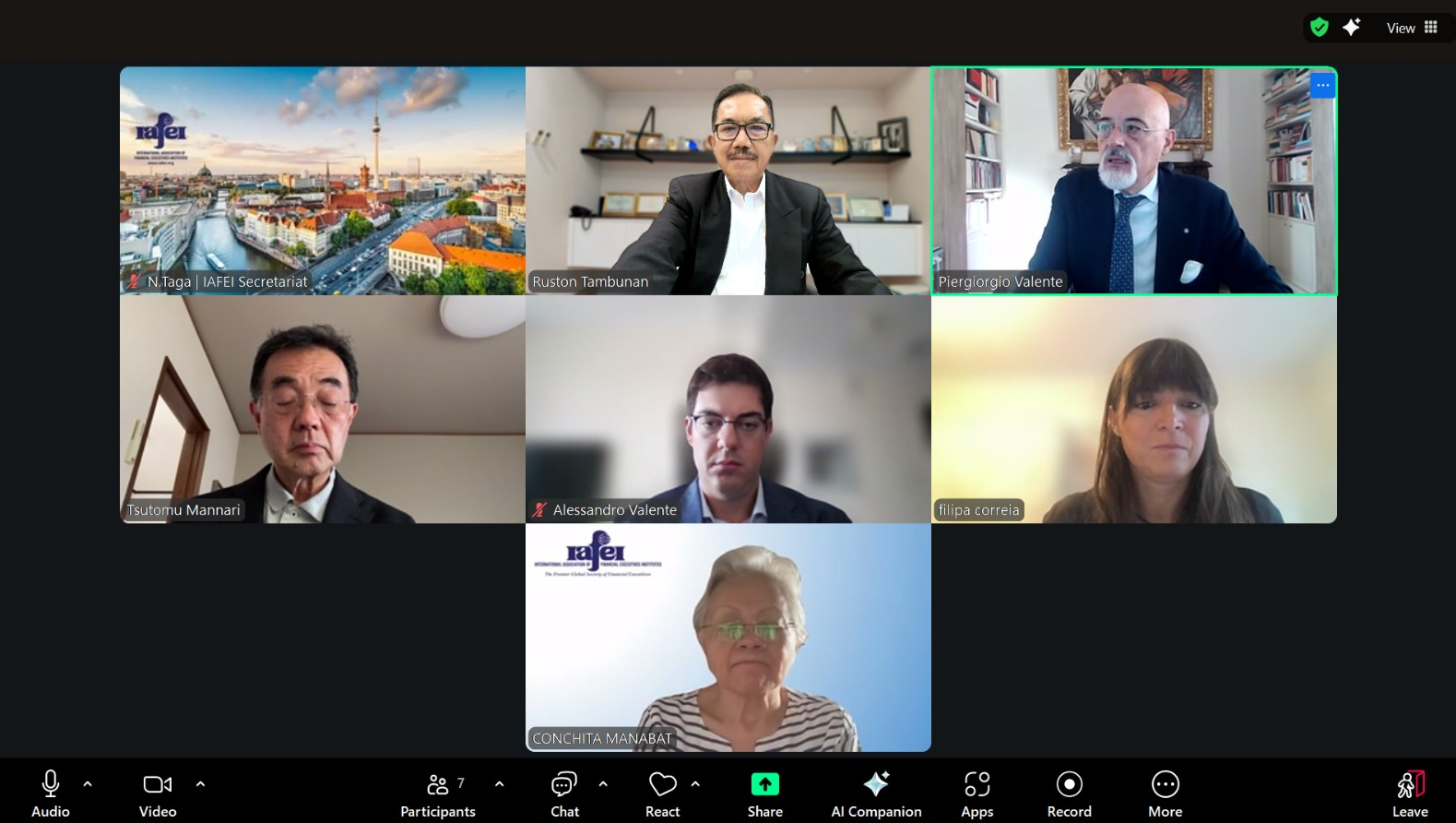

On September 29, 2025, Dr. Ruston Tambunan, the President of the Asia Oceania Tax Consultants' Association (AOTCA), had the honor of being one of the distinguished speakers at the Global CFO e-Roundtable hosted by the International Association of Financial Executives Institutes (IAFEI). IAFEI serves as an observer to the Global Tax Advisers Forum (GTAP), where AOTCA is one of the founding members alongside CFE and WAUTI. This roundtable brought together global leaders and senior financial executives to discuss critical issues in international taxation that directly affect Chief Financial Officers (CFOs).

In his presentation, Dr. Tambunan addressed the ongoing implementation of the Global Minimum Tax (GMT) under the OECD/G20 framework. He explained how the rules surrounding the Qualified Domestic Minimum Top-up Tax (QDMTT), the Income Inclusion Rule (IIR), and the Undertaxed Payment Rule (UTPR) are designed to ensure that large multinational enterprises (MNEs) with consolidated turnover exceeding €750 million pay at least a 15% tax worldwide. He also outlined the practical implications for CFOs, which include: a potential of increase in tax burden from top-up taxes, rising compliance and administrative costs that necessitate new data collection and reporting systems, and strategic changes in tax planning, emphasizing substance over form and careful consideration of investment locations.

Dr. Tambunan provided a regional update, noting that countries across Asia, including Japan, Korea, Vietnam, Singapore, Malaysia, Indonesia, Hong Kong, and Thailand, are in the process of implementing GMT rules.

Additionally, he emphasized the increased scrutiny on transfer pricing (TP) globally. Dr. Tambunan highlighted the importance of having robust TP documentation and conducting benchmarking analyses in accordance with the arm's length principle.

He also stressed the need to be prepared for audits and to utilize dispute resolution mechanisms such as Mutual Agreement Procedures (MAPs) and Advance Pricing Agreements (APAs). Key risk areas identified included intercompany transactions in goods, services, intangibles, and financing arrangements. He urged CFOs to adopt a forward-looking approach by strengthening internal policies, ensuring audit readiness, and proactively managing potential transfer pricing adjustments.

Through his participation, AOTCA reaffirmed its commitment to providing thought leadership on global tax matters and supporting its members, stakeholders, and financial executives across the Asia-Oceania region. Participation in the Global CFO Roundtable demonstrates AOTCA's dedication to engaging with international partners on pressing taxation issues.